Building Investment Excellence

Chantico Global provides a robust asset allocation framework and focused investment consulting services for investment committees, institutions, asset managers, wealth management firms, and other professionals who seek to consistently grow assets while minimizing risk and loss of capital for their constituents.

In a nutshell:

- Chantico Global can provide investment frameworks that support high conviction investment decisions.

- Our proprietary process is supported by intuitive, rigorous models that foster the confidence your team needs to move forward with conviction.

- Chantico Global clients include public, corporate, state and sovereign pension funds, foundations, endowments, insurance funds, family offices, wealth management firms, robo advisors, macro hedge funds, private equity/credit funds, private real estate funds, impact investment funds,and investment banks.

- ESG investing strategies are supported by internal research and proprietary sustainability overlays.

- Services may include a strategic review, a tactical review and/or a process review.

- Bespoke research projects can include macro trend analysis applied to sectors and industries as well as scenario design and risk analysis.

- Consistent inputs coupled with professional insights and analysis will help us produce a Decision Tree that supports your goals and objectives.

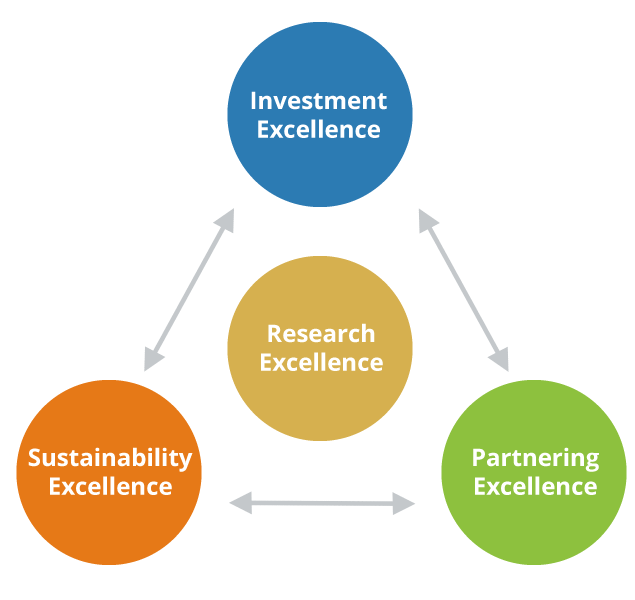

Chantico Global Provides

When you need to make deliberate, informed investment decisions, Chantico Global stands ready to provide the insights you need to move forward with clarity and conviction.

Sign up for our updates & news

* These fields are required.

* We have a 100% No Spam Policy!

Make High Conviction Decisions

Build your strategy on a solid foundation, with one set of unified assumptions, and a disciplined process that will provide the framework you need to adopt the right models and make high conviction decisions.