Trading Nation: Amazon weighs down Nasdaq from CNBC.

After the company topped $1 trillion in market cap earlier this month and set new records, Amazon’s shares have pulled back more than 7 percent. Just this month, they have dropped nearly 5 percent in what could be their worst performance since November 2016.

One technician says the charts point to a snapback.

“The trend is still higher and intact. Amazon still ranks very highly in our momentum work,” Ari Wald, head of technical analysis at Oppenheimer, said Monday on CNBC’s “Trading Nation.”

Momentum stocks are characterized by sharp increases and little volatility over a relatively short period of time. Amazon shares have steadily risen this year with brief bouts of trouble in February and March when the rest of the market tumbled.

“This is a very minor pullback in Amazon. No support levels have been breached,” said Wald. “In general, the momentum strategy is based on letting your winners run, cutting your losers quick, and Amazon is a winner. Let it run.”

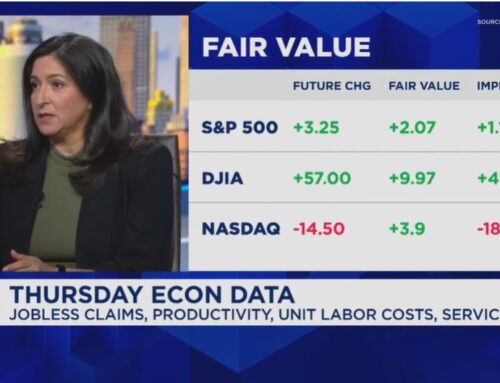

As Amazon sold off Monday alongside tech, Citi analysts floated the idea of a split between its retail and Amazon Web Services businesses to avoid antitrust concerns. Gina Sanchez, CEO of Chantico Global, told “Trading Nation” the desire for a split is understandable but misguided.

“They’re starting to really expand their margins and obviously AWS is a big piece of that. I think that’s why people want to break that off,” Sanchez said Monday. “But, Amazon has been buying more product lines. It has been doing Amazon Basics, and has been continuing to take market share. And so I do think they’re going to be growing their margins there as well.”

Operating margins in its AWS segment have grown to nearly 27 percent as margins on North American sales expanded to 5.7 percent.

“I think this is still a totally integrated story, and there’s no need to chop it up,” Sanchez said.