The Dow just roared 1,000 points higher in a single session after December sell-offs swept its internals to extremes.

Before Wednesday’s session, more S&P 1500 stocks were at 52-week lows than any other time since November 2008. The put-call ratio, a sentiment indicator in the options market, was also at its most bearish since 1995.

Those extremely oversold conditions have Miller Tabak equity strategist Matt Maley seeing positive signs in the market.

“It tells us we can finally see a real bounce here,” Maley said Wednesday on CNBC’s “Trading Nation. ” “If you look at the chart on the S&P 500, it touched a key support level on Monday, that’s its 200-week moving average. That’s the level that held in 2016 and in 2011 when we had the European crisis so that should provide some good support here.”

The S&P 500 briefly was at that level during its worst Christmas Eve session ever on Monday, but now sits nearly 5 percent above its longer-term trend line.

“If you look at the weekly RSI chart, it’s the most oversold it’s been since those 2011 lows. Now in 2011, about a month we came back and tested those lows so we may have to see that in a couple of weeks but I think this is a kind of a bounce that will start a rally of anywhere from 8 to 12 percent over the next couple of weeks,” Maley said.

Its weekly relative strength index reading, a measure of momentum, hit 31.47 on Friday, its lowest level since August 2011. A reading around 30 generally suggests oversold conditions. A 12 percent rally would take the S&P 500 back up above 2,700 and to levels not seen since the beginning of the month.

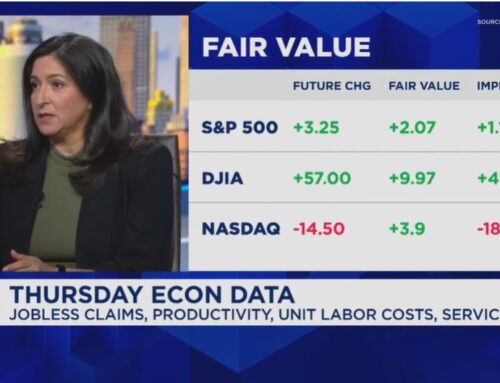

Gina Sanchez, CEO of Chantico Global, is less certain the bounce can last. She said the macro safety nets that supported markets in the past are now absent.

“These lows held in 2011 and 2016, but interestingly at those times, we also got significant QE that helped the markets and you also had a tax stimulus package that happened after 2016 so there was additional push,” said Sanchez on “Trading Nation” on Wednesday.

The GOP’s tax bill, passed a year ago, was credited with a bulk of the market gains this year before volatility took over in the fourth quarter. At its September peak, the S&P 500 had rallied 10 percent for the year. Even after Wednesday’s surge, the benchmark index remains more than 5 percent lower in 2018.

“Will there be opportunities? Absolutely, there’s always opportunities. However, what is the longer-term trend for the S&P as an aggregate? I think that’s what’s in question,” said Sanchez.