The market’s mixed reaction to Microsoft’s earnings report has called software’s rally into question.

The tech giant beat Wall Street’s expectations on the top and bottom lines in its fiscal fourth-quarter earnings report on Wednesday, but softer-than-expected revenue guidance weighed on the stock, which has climbed nearly 50% since the market’s March lows.

Oppenheimer on Thursday downgraded Microsoft to market perform from outperform in response to the report, citing “materially” slower growth in its cloud segment, Azure, despite the success of Microsoft’s consumer-facing products.

Microsoft shares closed more than 4% lower on Thursday at $202.54.

“Part of Microsoft’s issue has been that it has been very strong,” Gina Sanchez, founder and CEO of Chantico Global, told CNBC’s “Trading Nation” on Thursday.

“Its outlook was already strong going into the pandemic and the pandemic even boosted demand for its products even more,” she said. “The question that remains is does that boost mean that they will not get demand later? Has it just pushed forward demand that was already there, or has it created new demand?”

For Sanchez, the answer was likely the latter.

“We think that the pandemic has actually created new demand,” she said. “So, we’re going to disagree on this, and we think that the outlook is still strong. But … if you look at the price action, it has been very strong, and so, seeing a blow-off in Microsoft isn’t that surprising.”

Bill Baruch, president and founder of Blue Line Capital and Blue Line Futures, agreed from a technical perspective.

“When something rallies like this, you have to be prepared for it to cool off,” he said in the same “Trading Nation” interview. “Be patient. Know your buying spots.”

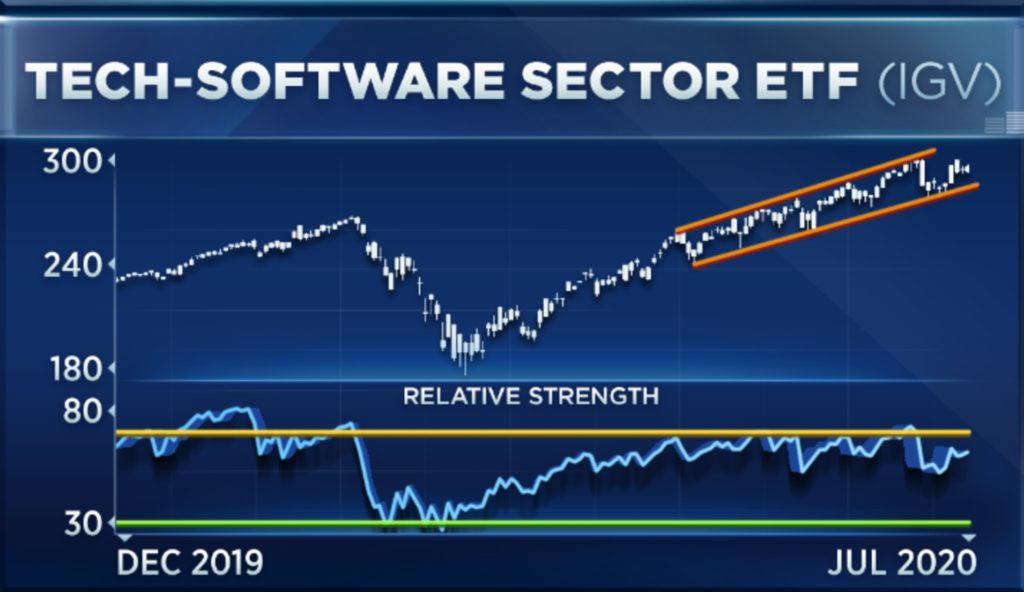

Pointing to a chart of the iShares Expanded Tech-Software Sector ETF (IGV), Baruch said the uptrend was very much intact.

“There’s a nice channel. And that support trend line — that’s where I’d be looking to be a buyer, [$]285,” he said. “Volatility in general here surrounding earnings is nothing new. We saw that at the end of April with a lot of the tech behemoths reporting. Over this week and next week, I think the volatility’s going to continue. So, again, what you want to do is know your spots.”

The IGV closed down 2% at $288.14 on Thursday. It would have to fall a little over 1% to reach Baruch’s $285 target.

“That’s where I’d look to be a buyer,” he said. “I expect the trend to stay intact, but if it starts breaking down through that trend line, you want to be more cautious and manage your risk.”

When it came to risk, Sanchez had a few more words of advice: “Understand what you’re buying.”

“In the case of Facebook or Apple or Microsoft, those are all driven by very different things,” she said. “This pandemic has actually reminded us that individual stocks have individual stories. I think that you want to buy into technologies that will help make businesses more resilient because that is front of mind right now and that is an investment that will pay itself back … down the road. I don’t necessarily put Facebook in that category.”

Story by :